Using Automation to Streamline BAU Processes

In our recent research, we asked 150 business innovation leaders how long it takes them to implement Bank of England base rate changes. The average response was 65 days. Clearly, some banks are using legacy tech that simply does not cut it in the modern world of banking. We are often surprised to find that even relatively new technologies are unable to deliver the speed and functionality required of today’s banking. Not all ‘cloud-native’ cores are truly leveraging the architectures that deliver the time savings and immediacy offered by SaaScada.

This becomes very clear early in our new prospect meetings or during RFPs, when our potential clients will often share information about their current processes to establish if we can meet their existing timeframes. One of the things we’ve found truly shocking is the benchmark of what ‘good’ looks like, even when using relatively modern cores.

For example, we were recently asked if we could match the speed of a financial institution’s existing core technology for making rate changes on products linked to the Bank of England base rate. In this instance, it was a five-step process that took a minimum of four hours to complete and involved both IT and product teams. When we told them we could reduce that to two minutes, without the need to involve IT, they were shocked.

So, how do we do it?

Let the tech do the heavy lifting for BAU

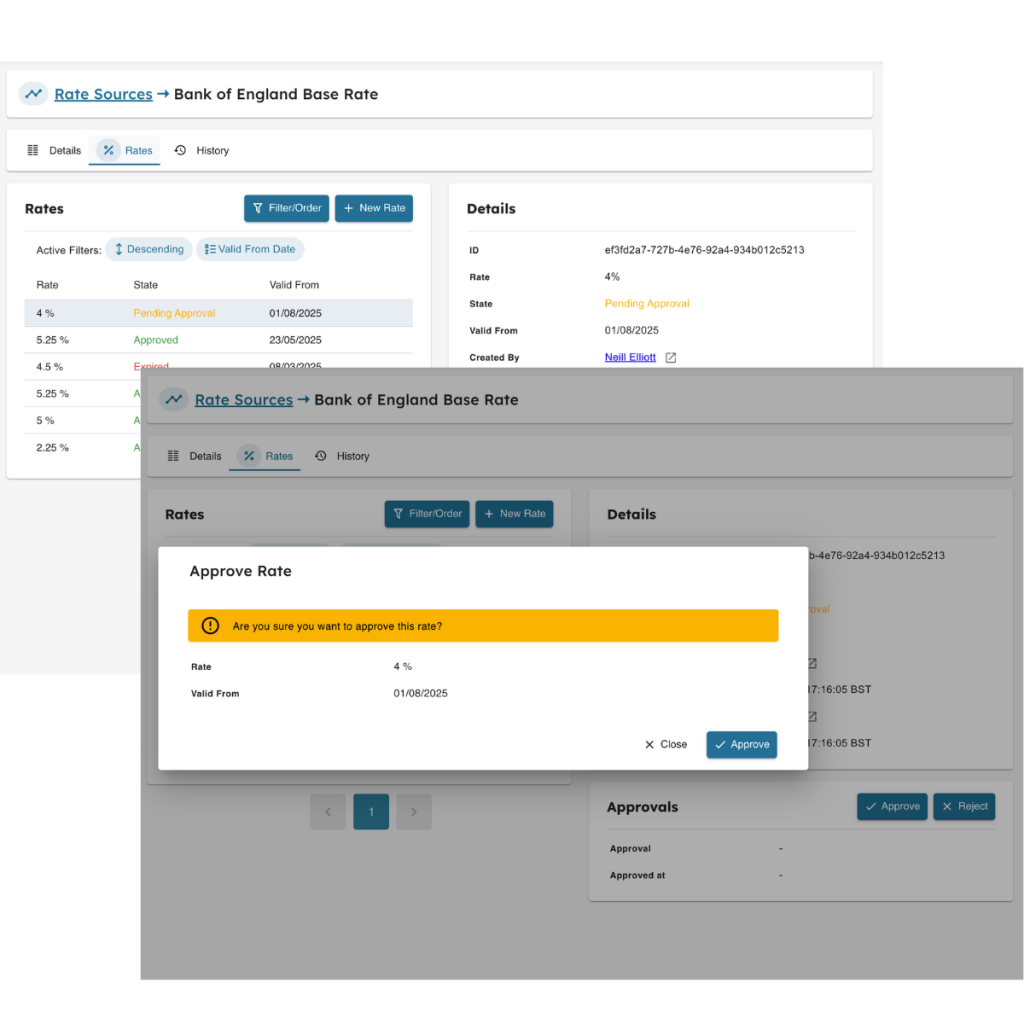

We’ve designed functionality that allows all rates at a product or account level to be linked back to a centrally defined rate known as a ‘Rate Source’. When a change is required, it is simply a case of updating the rate within the rate source, along with an effective date. We understand that rate changes aren’t just about the tech, so an approval process is built-in to allow risk and compliance teams to decide the level of oversight needed for any changes.

Once the new rate becomes active, it is automatically propagated across all products and accounts that reference this rate source. The financial institution has control over whether the rate source is a base rate or a specific lending and savings rate they choose. The beauty of this approach is not only the ease with which changes can be made, but that it allows specified calculations to set the interest rate for each product. For example, a savings account that is ‘Rate Source’ – x%

It is this type of automation that we have introduced across multiple BAU functions to enable our clients to reduce the time committed to BAU admin. This frees admin teams to focus on value-add work and, quite frankly, enhance job satisfaction for those who normally spend hours each month in repetitive tasks that can now be automated.

Increase speed, reduce risk

With our 2025 research showing that 56% of institutions take longer than a week to respond to maturity instruction requests, including a shocking 37% taking longer than a month, better functionality is sorely needed across the market. By automating this process, we both increase customer satisfaction and reduce manual back-office work.

It is no surprise that one of our most heavily used functions has been the automation of maturity instructions, allowing customers to directly choose options at maturity via the institution’s website or app, rather than sending an email or written instructions.

When the maturity window opens, we fire a webhook so that the financial institution can send a push notification or email to their clients. The customer then goes into online banking or the mobile app and makes their choice from a range of options, including splitting the balance across multiple products or paying out some of the balance and reinvesting the rest.

The time savings, cost savings and reduction in potential errors are considerable. In addition to removing the need to print, post and await manual instructions to be returned via post, it also removes the risk of data entry mistakes once instructions are received. This simple process can also allow customers to make self-selection much closer to the maturity date than would be possible with a paper instruction.

These are just a couple of ways we reduce BAU manual processing and mitigate risk.

How can we help you reduce time dedicated to BAU functions?

Learn more in this video.